" might be good news, because as a business is growing is often when you start to have those cash flow problems," said Facebook's Sheryl Sandberg in an interview with Inc. That’s why you shouldn’t be alarmed if you see more money leave your business than come in-at least initially. You might need to buy new equipment, pay for a website, or put down a deposit to rent office space. If you’re thinking about starting a business or you recently launched a new one, you’ll need to invest some cash in the early days to get set up. But when your cash only trickles in, you can stumble into cash flow issues. When you have enough money put aside, it’s easier to pay your expenses as they come due. Positive cash flow is what makes your business flourish, and the pace of cash flow is just as important as having cash flow at all. This may include employee payroll, bank loans, or other business expenses.Ĭash flow is the lifeblood of your business. This is an important part of calculating the profitability of your business.Īccounts payable is a liability account that tracks the money leaving your business (as we mentioned, this is the money that you owe).

What is accounts receivable?Īccounts receivable is an asset account that keeps track of money coming into your business (money you receive from your customers for the goods and services you provided). Accounts payable rounds up your liabilities, like payments or debts you owe. Accounts receivable represents your assets, like a positive bank balance or cash on hand. It’s important to differentiate between accounts receivable and accounts payable. Accounts receivable versus accounts payable revenues and income), that’s when you have a cash flow issue.

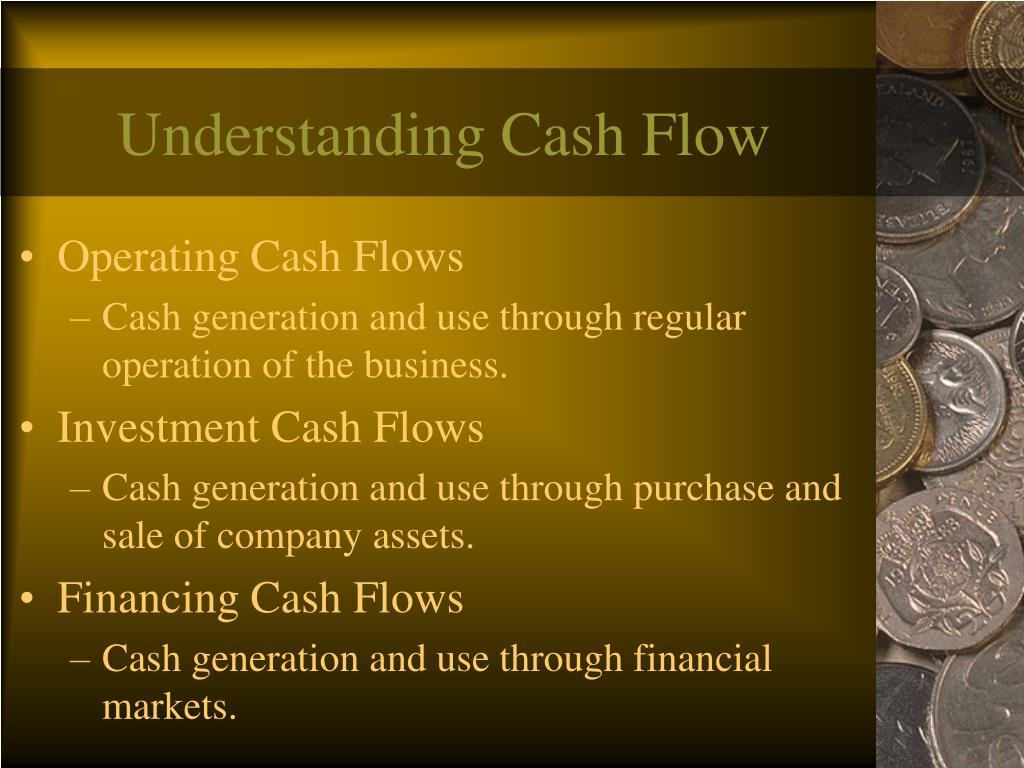

expenses) exceeds the cash coming into your business (i.e. But when the cash flowing out of your business (i.e. When you have more than enough money in your account to cover your bills, you have a positive cash flow. Think of it this way: Your cash flow represents all the transactions you make. Let’s answer the question on everyone’s mind: What is cash flow? Defining cash flow is simple: Cash flow represents the movement of money in and out of your business.

0 kommentar(er)

0 kommentar(er)